The wealth management industry has evolved around the need to secure one’s future. Hundreds of savings and investment products are developed each year by product experts. Marketing gurus create the sales pitches. Operations and Technology folk create the systems. Lawyers add the fine print. And then an army of bankers, advisors, and agents pitch them to you. It can get confusing and overwhelming, especially when your money is at stake.

Let me simplify this entire dog and pony show for you:

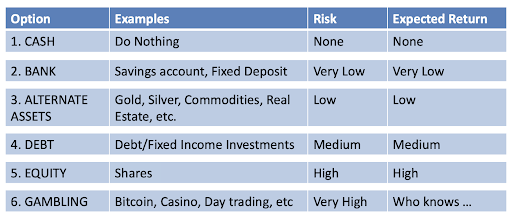

You essentially have SIX OPTIONS to invest your money. That’s it.

Each option carries a different risk level and, as we saw in the last blog, therefore offers a different expected return.

OPTION 1. CASH: You can literally do nothing with your money–keep it in your wallet, under your mattress, in wardrobes…This option has no risk (other than entirely unexpected events such as theft, demonetization etc.). And obviously, there is no financial return–money stuffed under your mattress will not grow.

OPTION 2. BANK: You can save your money in a bank–in a savings account, where you will earn some interest. Or, as a fixed deposit, where you lock in your money for some period and get a slightly higher rate. Risks are very low–your money is safe unless your bank fails, which is rare in India. But the returns are also low; the approximate savings and FD rates are between 3% to 7% p.a. presently.

OPTION 3. ALTERNATE ASSETS: You can buy alternate assets such as gold, silver, commodities, real estate, etc. These have intrinsic value and appreciate with time; the returns vary depending on the asset and other factors. But given their scarcity, and the fact that they are not very correlated with other assets, the risks are relatively lower.

OPTION 4. DEBT: When you lend your money to someone–whether an individual, company or government–you invest in Debt. You expect to get your money back, along with additional interest. The risks vary depending on who you are lending to–governments are relatively safe, companies riskier. The broad returns on debt instruments are presently between 6% and 10%.

OPTION 5. EQUITY: When you invest your money in a company for a stake (shares), however minuscule, you invest in Equity. Unlike debt, there are no guarantees of getting it back, but you instead share in the company’s profits and growth. Investing in equity is undoubtedly riskier than debt or all the other options seen so far. But the returns are commensurately higher. Equities over the past decade have averaged over a 12% p.a. return.

OPTION 6. GAMBLING: I use the term not in a derogatory manner but to denote any option that one doesn’t fully understand or that depends on a lot of luck. So, whether it is cryptocurrencies, day trading, buying stocks on random tips, or betting in racecourses or casinos, I classify all of it as gambling. The returns can be huge, but obviously, so are the risks.

To summarise, these are the fundamental investment options–each with a varying level of risk and the higher the risk, the higher the expected return. Any savings or investment product you encounter is likely a variation, permutation or combination of one or more options. So, a Balanced Mutual Fund combines 4 & 5, a Sovereign Gold Bond is 3 & 4, and so on.

Investing everything into any one option will not be prudent–there is no point in hoarding all your cash, nor in gambling it all.

Instead, you need to find the right balance between all options–basis your risk appetite, goals, and time horizon.

And that is what the industry can very easily help you do–if you have the time, they have the tools and training. So, the next time someone pitches a product you might want, first ask them to help you understand what you need.

0 Comments