For many people, budgeting is one of the most mundane activities that one can undertake. And the fact that you have chosen to click this link is awe-inspiring! I will quickly guide you on what needs to be done and, more importantly, share one of the golden rules of personal finance that will put your journey to financial freedom on an entirely different track. But first, budgeting!

Making a Budget

You have income coming in. You have expenses going out. So budgeting is planning, to the best extent possible, how much you can spend on what activity so you know, with some certainty, what you have left to save and invest.

Why is it so mundane? Because ideally, we don’t want to be constrained when it comes to expenses. We want to get what we want when we want it, without worrying whether we can afford it. And it’s a chicken and egg situation.

If you are prudent with your finances, you can reach a stage where you don’t need budgets. But the first step to being prudent is to make a budget.

Making a budget is simple: note down all the essential items you spend money on and put a target expenditure amount against each.

Rent: Rs. _____ per month

Utility Bills: Rs. ____ per month

Transport: Rs. ____ per month

And so on for all categories: Groceries, Dining Out, Entertainment, Shopping, Travel, etc.

The total is the maximum that you can spend in any given month. And obviously, this should be lower than your income–you should not be taking loans to fund your lifestyle.

Once you have prepared your budget, itemize your expenses at the end of the month and see how you did. And if you do this for a few months, you can spot trends you can fix. For example, you may be spending much more on eating out than planned and need to control that. Or cabs are costing you significantly more than budgeted, and you may need to move to public transport for a month or two. Regularly taking stock of your expenses keeps you in control of your finances.

Expense Calculator

If you would like a simple calculator that will help you understand how you are spending and saving, you can try this here:

While budgets are great, we are human, though, and I need to be realistic. Unless you were born with a chartered accounting spoon in your mouth, it could be quite the struggle to do this month after month.

So at a bare minimum, pick any four random months in the year and track your expenses closely in those periods. While it will not give you the perfect picture, you should still be able to spot areas for course correction. And once you get into the rhythm of doing this every few months, you might be inclined to do it more often.

Once you have your income and expenses under control, you can focus on saving and investing–the core activities that will take you to financial freedom. And budgeting, therefore, is a crucial aspect of the journey.

Golden Rule: Pay Yourself First

Now onto the golden rule that will set the foundation of your financial planning journey for the rest of your life.

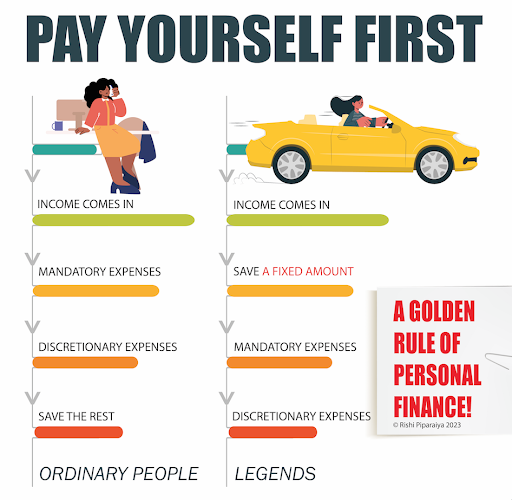

Most people around the world manage their finances in the following manner:

Step 1: Income flows into their account

Step 2: They pay for the mandatory expenses–rent, electricity, phone, internet, EMIs, food etc.

Step 3: They then make the discretionary expenditures–shopping, dining out, leisure activities etc.

Step 4: If there is any money hopefully left over, they save and invest it.

We are going to make one minor but critical tweak to this process. Each month, before spending on anything, you will park away some funds for saving and investing. So the process will be as follows:

Step 1: Income flows into your account

Step 2: Pay yourself first and move a fixed amount out for savings and investments.

Step 3: You then pay the mandatory expenses–rent, electricity, phone, internet, EMIs, food etc.

Step 4: Use whatever is left over for your discretionary expenses–shopping, dining out, leisure activities etc.

This strategy is called “Paying Yourself First” and is considered one of the golden rules of personal finance. We have simply moved Step 4 to Step 2. And are treating “Savings and Investments” as you would any other mandatory expense, no different from rent or your phone bill. So that every month when your income comes in, you first pay yourself which means transferring out a fixed amount to save and invest. And then you pay the other mandatory expenses. And finally, use whatever is left over for your discretionary expenses.

The most obvious advantage of doing this is that you are saving and investing in a disciplined fashion every month.

Money gets invested before you can spend it, and you are leaving nothing to chance. Another benefit is that you have de-prioritized your discretionary expenses and moved them to the bottom of the pyramid. So you are first saving, then paying your rent, utilities and other mandatory bills, and only then spending on the items that are not sheer necessities. This is a far more prudent way to operate.

Use Monthly Standing Instructions

The best way to operationalize this is through a monthly standing instruction from your bank account to a savings/investment account. Choose the amount you want to save each month and set up the instruction for any convenient date–whether the first of the month, the day your salary gets credited, or any date that makes sense. But each month, money should automatically get debited and invested without your intervention. You need to absolutely fool proof the process.

Generally, one has few sources of income, but when it comes to expenses, one ends up making payments to all and sundry. If you review your credit card statements, UPI transactions, and bank accounts, you are likely making dozens of payments to various corporations, apps, vendors, and service providers. I want you to add one more payee to the list: yourself. And each month, pay yourself first.

4 Comments